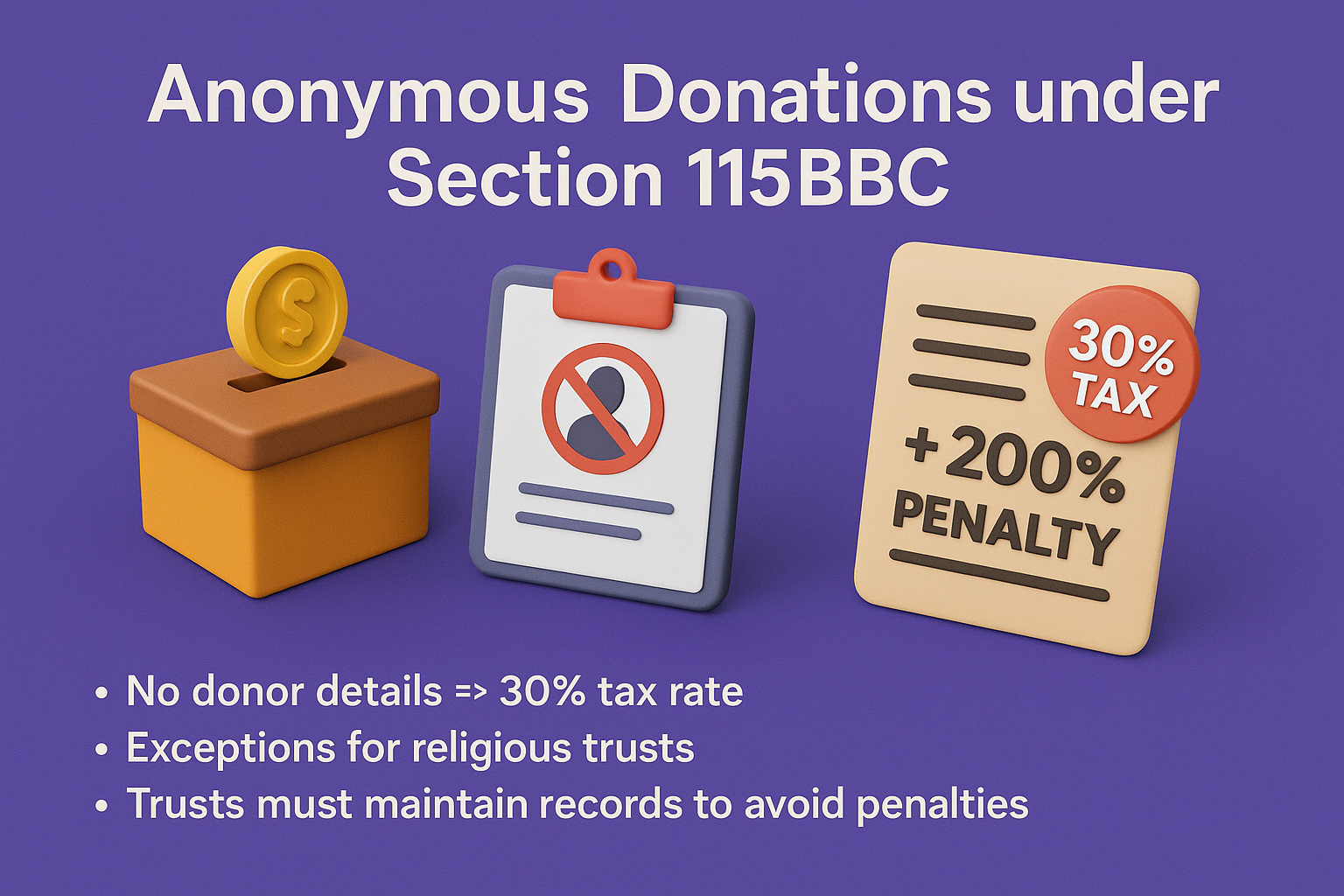

Anonymous Donations under Section 115BBC – Rules, Limits & Penalties

Definition (Anonymous Donation)

Section 115BBC targets “anonymous donations” received by certain entities. An anonymous donation is defined as any voluntary contribution (as in Sec.2(24)(iia)) where the recipient trust does not maintain a record of the identity (name, address, PAN) of the donor. In other words, cash or other donations for which the trust has no proper donor details are treated as anonymous. Collecting donations via untraceable means (coin boxes, street collections, etc.) often fall under this category.

Taxation Rules (Section 115BBC)

The law provides that income by way of anonymous donations received by a trust/institution is to be added to its total income and taxed at a flat 30% rate. Importantly, this is a special tax: the trust cannot claim deductions or exemptions on this income. In effect, the trust forfeits the tax-exempt status of those receipts. For example, if a trust receives ₹2 L via anonymous cash donations, ₹2 L must be shown as income and taxed at 30% (plus surcharge/cess).

However, Section 115BBC(2) carves out exceptions. It exempts such tax where the trust is “created or established wholly for religious purposes” or “for both religious and charitable purposes”. Thus an institution devoted solely to religious activities can still receive anonymous gifts without tax. But if the donation (even by such trust) is specifically for an educational or medical institution run by that trust, it loses the exception.

Thresholds and Aggregation

Initially (from AY 2010–11), anonymous donations were taxable only if the aggregate for the year exceeded ₹1,00,000 or 5% of total donations (whichever higher). Finance Act 2021 greatly tightened this: any anonymous donation above ₹10,000 in a year is now taxable at 30%. (Effectively, a mere oversight in recording a small donation above ₹10k triggers tax.) Tax management guidelines now treat all anonymous contributions as taxable unless each is below ₹10k. There is no longer a high-threshold exemption.

Example

Trust A collects ₹50,000 in casual cash donations via donation boxes from the public in FY 2023–24. None of these donors gave their details. Under Sec.115BBC, Trust A must add ₹50,000 to its income and pay 30% of ₹50,000 (i.e. ₹15,000) as tax. If in contrast Trust B, used for both education and charity, received ₹50,000 anonymously for its general corpus, it too must pay tax (since it is not “wholly religious”).

Reporting Requirement (Form 10BD)

Effective FY 2020–21, charitable trusts with 80G or 35(1) approvals are required to file Form 10BD annually, listing all donations (with donor details) received during the year. While this was introduced mainly to monitor tax-deductible donations, it indirectly pressures trusts to collect and record donor information. Not filing 10BD (when required) attracts penalty (Sec.271K) – although this is separate from 115BBC. Nonetheless, routinely collecting PAN/receipts avoids “anonymous” status.

Penalties

If a trust fails to pay the due tax on anonymous donations, it faces severe penalties. Section 271BA (inserted by FA 2021) prescribes a penalty of 200% of the tax payable on undisclosed anonymous donations (effectively 60% of the donation) for willful default. Similarly, a trust intentionally omitting an anonymous donation can end up paying the entire tax shortfall. Additionally, late payment of this special tax can incur interest under Sec.234A/234C/234B.

Practical Tips

Common Pitfalls

Recent Developments

The Finance Act 2021 clarified and broadened these provisions. In particular, it reduced the threshold from ₹1 L to ₹10,000 and extended Sec.115BBC to certain educational/research institutions as well. The government has also emphasized (via Rule 18AB and Form 10BD) that 80G-approved trusts maintain full donor details, making truly “anonymous” contributions harder to justify. Tax authorities now routinely inquire about donation receipts and may summarily apply Sec.115BBC if records are lacking.

Detailed Procedure for FCRA Registration and Renewal (Form FC-3A & FC-3C) Introdu...

Understanding Charitable Trusts in India In India, the most commonly understood form of constitut...

PUBLIC INSTITUTIONS EXEMPT FROM TAX [SECTION 10] The Income Tax Act of India, under S...

Corpus Donations: Legal Definition & Practical Use What is a Corpus Donation? A c...

How to File ITR-7: A Step-by-Step Guide Who Must File. ITR-7 is the Income-tax return f...

The rules and regulations that govern the functioning and operations of an Association of Persons ...

Non-Profit Structures in India: Section 8 Companies, Trusts, Societies, and AOP/BOIs In India,...

Government Grants: An Exhaustive Analysis Under Income Tax Law and Ind AS Framework Government...

Private trusts and family trusts are like magical shields that protect your money and property. Th...

Latest Rules for Renewal of 12AB & 80G Registrations Under current tax law, registe...