Corpus Donations: Legal Definition & Practical Use

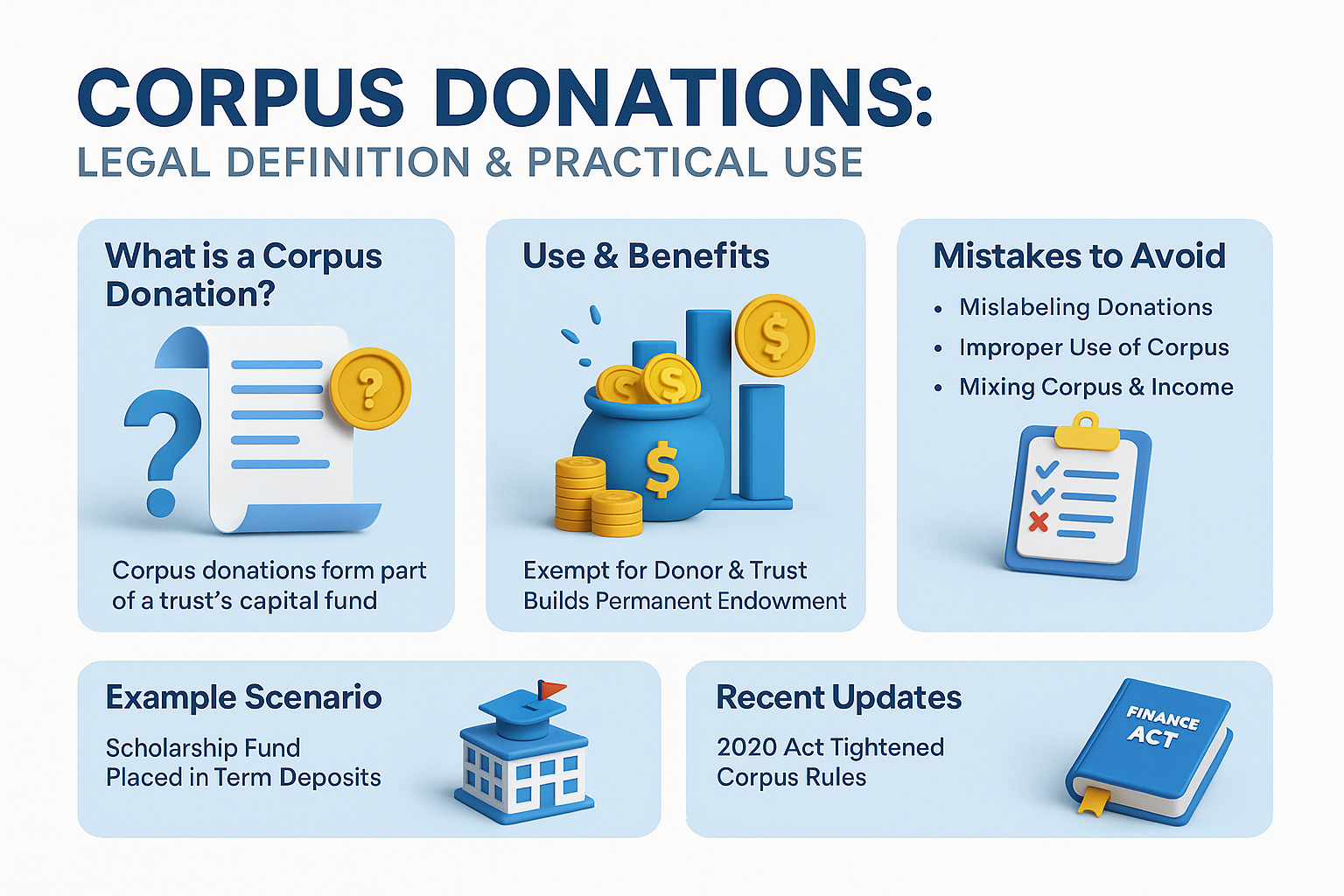

What is a Corpus Donation?

A corpus donation is a voluntary contribution made to a charitable trust with a specific direction that it form part of the trust’s corpus (capital fund) rather than being applied to current expenses. In legal terms, it is defined in Section 2(24)(iia) of the Act (for donors) and Section 11(1)(d) (for trusts).

Legal Definition

Although not explicitly codified as a separate definition, courts treat “corpus donation” as synonymous with donations “made with a specific direction that they shall form part of the corpus”. The Income-tax Act’s Explanation 2 to Sec.11(1) (added in FA 2020) further clarifies that contributions with direction to form part of another trust’s corpus are not treated as application of income.

Use of Corpus Donations

The trust must credit corpus donations to a separate corpus fund (often shown in balance sheet) and ideally invest them securely. Legally, the corpus itself is not to be spent on objects – only the income it generates may be applied to the trust’s objectives. For example, a “building corpus” donated for constructing a hospital wing must be invested in a separate fund; withdrawals for construction would breach the corpus.

If a trust does apply corpus donations (e.g. it draws ₹5 L from the corpus to build an outreach clinic), special rules apply. Finance Act 2020 added that using corpus for charitable purposes is not treated as application of income for the 85% rule. Thus the trust effectively loses tax shelter on that amount – it must count it as normal income for exemption calculation. (Practically, this discourages dipping into corpus except for actual capital investment.)

Example Scenario

XYZ Memorial Trust received ₹50 Lakh from a donor to endow a scholarship fund, explicitly stating it be kept as corpus. The trust places this ₹50 L in term deposits. Each year, the interest (say ₹3 L) is applied to scholarship awards and is tax-exempt (as income from property under trust). The ₹50 L corpus itself is not used and is exempt from tax as corpus donation under Sec.11(1)(d).

Case Law

The tax treatment of admissions or capitation is relevant. In N. H. Kapadia Educational Trust v. Asst. CIT (2024) 467 ITR 278 (Guj.), parents paid fees on admission, which the trust declared as corpus donations. The HC held these amounts were indeed corpus donations (since no evidence of separate capitation intent) and so exempt under Sec.11(1)(d). The court cautioned that absent proof to the contrary, payment marked “corpus” is respected. This underscores the need to treat genuine corpus-designated payments as non-taxable, capital receipts.

Benefits of Corpus Donations

They build the trust’s capital base, providing sustainable funding (through the income yield). For donors, corpus contributions attract tax deductions (subject to 50%/100% limits). For trusts, corpus donations are fully exempt and are excluded from the 85% application requirement (unlike applied income).

Disadvantages & Caveats

Income is available – but the trust cannot use the principal for running costs. Also, Supreme Court has held (in CIT v. Azam & Salimuddin (1987) 166 ITR 242 (SC)) that a donation becomes taxable if donors revoke or amend their direction – it is income unless backed by the donor’s intent. Another caveat: post-2020, under Explanation 2 to Sec.11(1), a corpus donation given to another trust’s corpus does not count as application of income. Thus a trust cannot receive a corpus gift and then pass it on as corpus to a second trust expecting to meet its 85% target.

Mistakes to Avoid

Recent Updates

Recent law clarifications emphasize corpus handling. Finance Act 2020’s Explanation 2 to Sec.11(1) clarifies that transfers to another trust’s corpus are not applications of income. The donation (and its income) remains exempt, but neither trust can count it toward their 85%.

Also, Budget 2023 proposed that only 85% of grants to other charitable entities (not corpus) would count as application, indirectly affecting how trusts route corpus. In practice, trusts should monitor tax authority guidance on corpus reporting (e.g. in ITR-7, Schedule VC for voluntary contributions and Schedule EC for capital application).

What is a REIT? A Real Estate Investment Trust (REIT) is a company that owns, manages, or ...

Is GST Registration Required for Section 8 Companies? With the introduction of the Goods and Ser...

Electoral Trusts and Electoral Bonds: An In-Depth Overview 1. Introduction Political funding...

Government Grants: An Exhaustive Analysis Under Income Tax Law and Ind AS Framework Government...

The rules and regulations that govern the functioning and operations of an Association of Persons ...

Understanding Charitable Trusts in India In India, the most commonly understood form of constitut...

Charitable Organisations – Taxation & Compliance (Legal Research Guide) Th...

Anonymous Donations under Section 115BBC – Rules, Limits & Penalties Definiti...

Latest Rules for Renewal of 12AB & 80G Registrations Under current tax law, registe...

Introduction: Section 8 Companies, a distinctive provision under the Companies Act, 2013, embody ...