Income from Business by NGOs: Section 11(4A) Explained

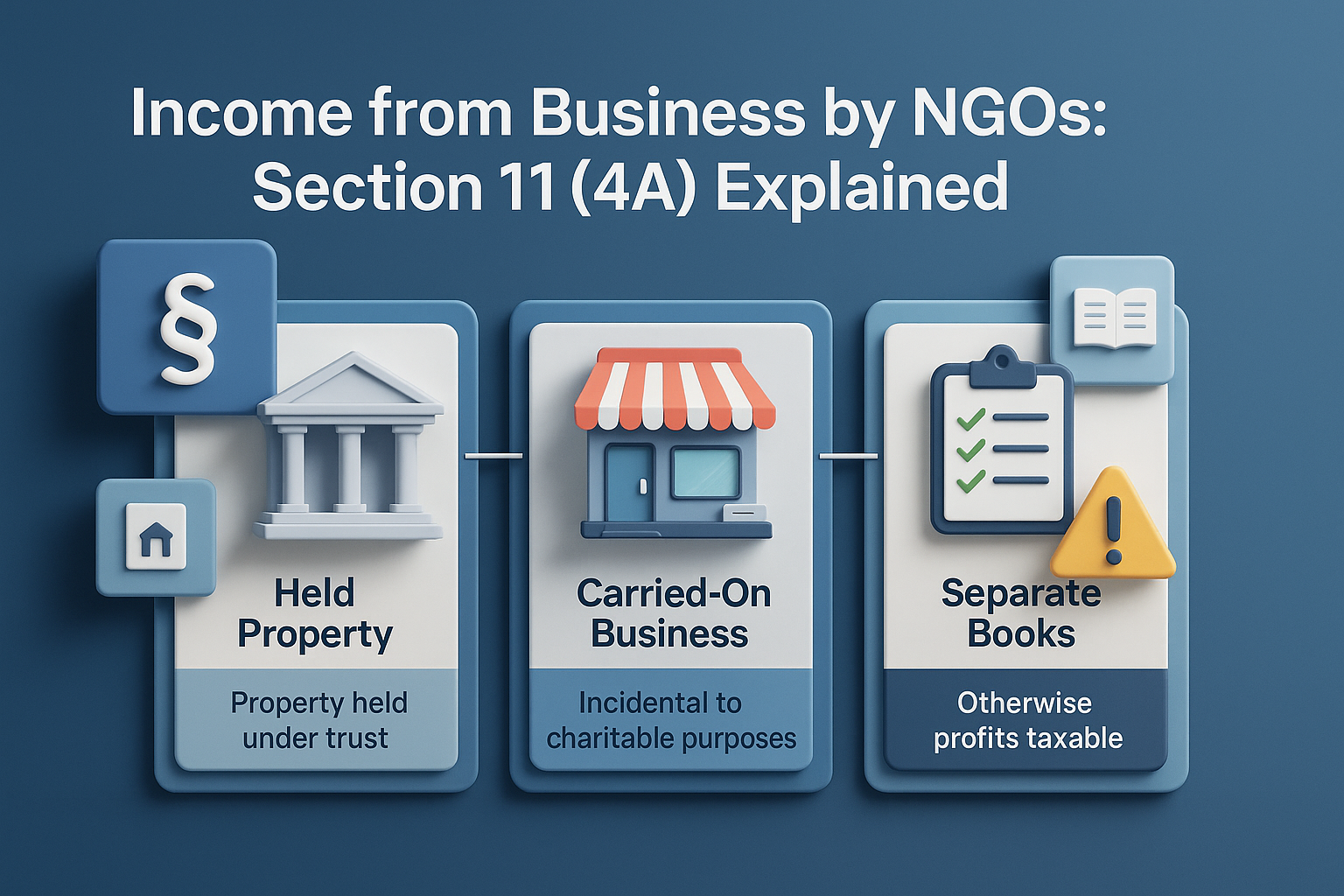

Legal Framework (Sections 11(4) and 11(4A)). Income from business activities of a trust is generally scrutinized to ensure the trust is not carrying on profit-making enterprises outside its charitable purposes. The Act addresses this through Sections 11(4) and 11(4A).

Key Distinction – Held Business vs Carried On: Section 11(4) vs 11(4A) were clarified by the Supreme Court in ACIT v. Ahmedabad Urban Dev. Authority (2022) 140 taxmann 471 (SC). The SC held that Sec. 11(4) covers cases where the trust’s entire enterprise is a business property, whereas Sec. 11(4A) deals with businesses carried on by the trust. The difference: if the trust’s corpus itself consists of a business undertaking (e.g. a trust formed to run a shop), Sec.11(4) applies; if the trust merely operates a business (e.g. an educational trust running a canteen or renting space), Sec.11(4A) governs.

The SC further stressed that “incidental” in Sec.11(4A) means truly ancillary to the charitable object. For example, an educational trust running a canteen for its students may be incidental, but renting classrooms or workshops to outsiders (generating revenue from non-charitable activities) is not incidental. The Court noted: “if charitable institutions provide their premises or infrastructure to outsiders (courses, workshops) and outsiders are permitted, then such income cannot be characterised as incidental to imparting education”. Thus trust income from unrelated commercial activities is disentitled from exemption.

Separate Books Requirement: Even if a business is incidental, exemption under Sec.11(4A) is available only if separate books are maintained. Failure to do so disqualifies exemption entirely on that business income. For instance, if a school trust runs an incidental shop but mixes its accounts with general funds, the AO can disallow exemption under 11(4A), rendering the profits taxable.

Illustration: A hospital trust sells cafeteria snacks to patients. This is incidental to its charitable mission (patient welfare) and if it keeps distinct accounts, the cafeteria’s profit can remain exempt. Conversely, if the trust hosts a music concert with paying attendees, that business is unrelated and would be taxable.

Case Law: The SC’s Ahmedabad Urban Dev. Auth. case (2022) is the landmark authority. It interpreted Sections 11(4) and (4A) in line with the above. It was emphasized that each assessment year stands alone: for future years, AOs must apply the new law consistently. High Courts and lower courts (including ITAT) have followed this.

It also noted that charitable activities linked to the core education mission like textbook sales or summer courses could be incidental, but third-party workshops are not. The upshot: “income from such activities must be examined year-by-year as to whether they are education or incidental...”.

Procedural Compliance

To ensure Sec.11(4A) relief, a trust should:

Benefits & Risks:

The benefit of Sec.11(4A) is that small-scale ancillary businesses can fund the trust without tax, provided compliance. However, if a business crosses the line of “incidental” or accounts are commingled, the trust risks losing exemption on all business profits. Moreover, because Sec.11(4A) disallows Sec.11 if not met, the entire business profit is fully taxable (at 30% + surcharge) – which can be a heavy tax burden.

Mistakes to Avoid

Not Maintaining Separate Ledgers: Many trusts run small shops or courses but don’t segregate accounts. This mistake can invalidate exemption on that business income.

Assuming All Activities Are Incidental: Income from clearly commercial operations (e.g. renting to outsiders, sponsorship deals, major event management) often fails the incidental test. Such incomes should not be claimed as exempt.

Ignoring SC Guidance: After the 2022 SC ruling, AOs may revisit older assessments. Trusts should ensure past claims under Sec.11(4A) truly met the test and be prepared with evidence (e.g. seating records showing only own students attended sponsored events).

Example: A charitable trust runs a workshop for its own students and sells merchandise to them. It also rents hall space to an unrelated NGO for a fair. The trust kept one set of books. Under Sec.11(4A), it can treat the workshop and merchandise as incidental and maintain exemption (if it organizes just for students). But the income from the fair (outsider event) is non-incidental – that profit is taxable. Also, to protect the exemption, the trust should have maintained separate accounts for the workshop/merchandise vs. the fair rental income.

Updates: There have been no new statutory provisions specifically altering Sec.11(4A) since the SC ruling, but trusts should note administrative updates: the CBDT has issued instructions (e.g. FAQs) referencing Sec.11(4A) compliance. For instance, union Budget 2023 commentary reiterates the need for separate books and that “Section 11(4A) imposes a further condition that separate books of accounts need to be maintained”. Practitioners should also monitor any clarifications from tax boards on implementing the SC’s requirements.

A Complete Guide to Legal Structure, Registration, and Taxation of NPOs in India Introduction ...

Corpus Donations: Legal Definition & Practical Use What is a Corpus Donation? A c...

Electoral Trusts and Electoral Bonds: An In-Depth Overview 1. Introduction Political funding...

Unregistered Trusts under the Income Tax Act, 1961 Legal Framework for Unregistered Trusts ...

BOI (Body of Individuals) and AOP (Association of Persons) are two different terms used in Indian ...

Non-Profit Structures in India: Section 8 Companies, Trusts, Societies, and AOP/BOIs In India,...

The rules and regulations that govern the functioning and operations of an Association of Persons ...

How to Apply for CSR Registration on MCA Portal Under Section 135 of the Companies Act and the C...

A Comprehensive Guide to Social Audit in India In the modern era, citizens have become ...

Is GST Registration Required for Section 8 Companies? With the introduction of the Goods and Ser...