Maintaining Books of Accounts for NGOs

Legal Framework

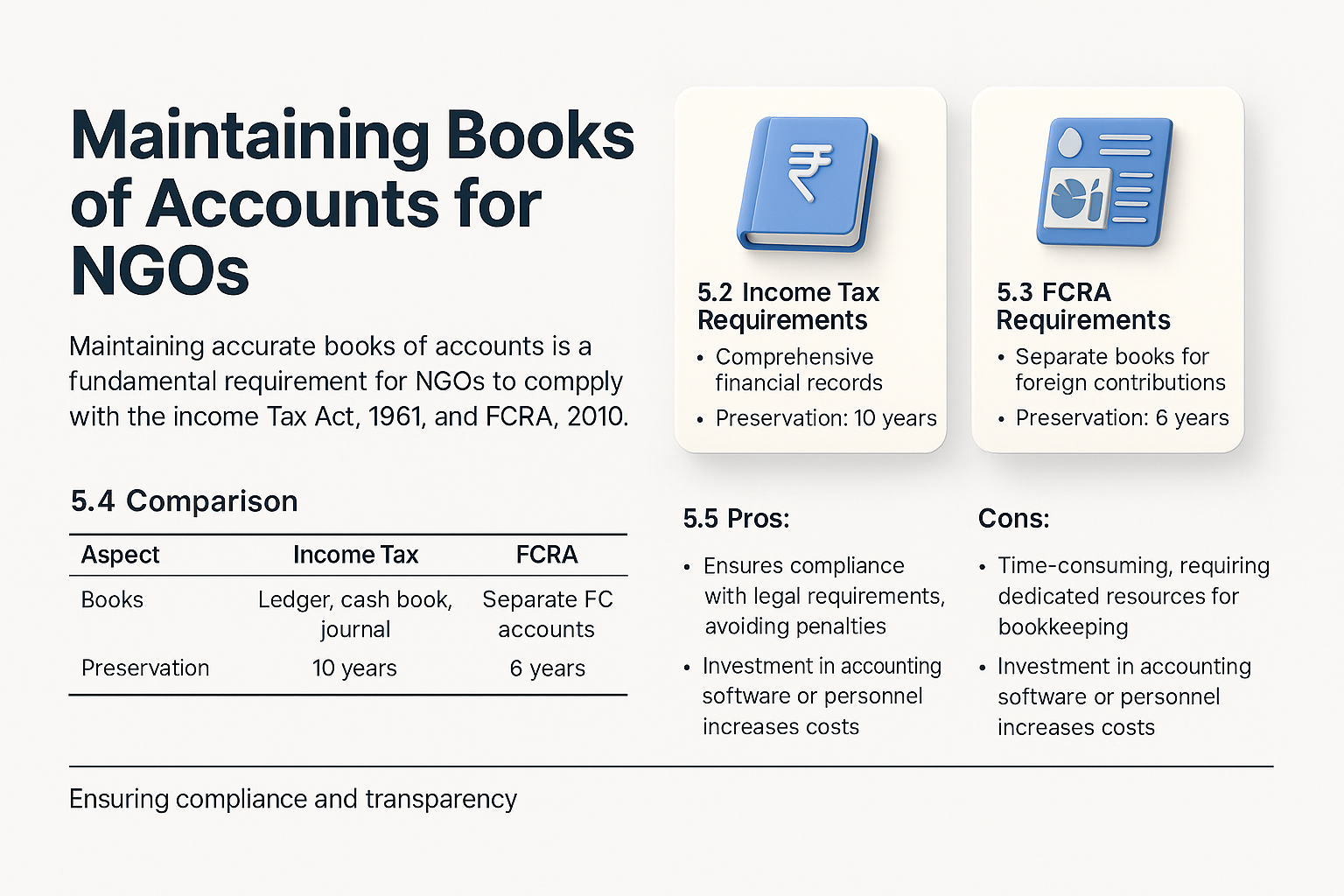

Maintaining accurate books of accounts is a fundamental requirement for NGOs to comply with both the Income Tax Act, 1961, and the FCRA, 2010. Under Rule 17AA of the Income Tax Rules, 1962, NGOsregistered under Section 12A(1)(b)(i) or Section 10(23C) must maintain detailed financial records. Similarly, Section 19 and Rule 11 of the FCRR, 2011, mandate separate books for foreign contributions, ensuring transparency and accountability

Income Tax Requirements

The Income Tax Act requires NGOs to maintain comprehensive financial records to substantiate their income, expenditure, and exemptions. The requirements include

Example: ”Child Welfare Trust” in Mumbai maintains a general ledger, cash book, and bills for its educational and healthcare programs. It uses accounting software to ensure accuracy and stores records in both physical and digital formats for 10 years, as required.

FCRA Requirements

Under the FCRA, NGOs must maintain separate books of accounts for foreign contributions to ensure compliance with Section 19. The requirements include:

Example: ”Child Welfare Trust” receives 20 lakhs in foreign contributions for a child nutrition program. It maintains a separate FCRA ledger in its SBI, New Delhi account, recording receipts and expenditures on a cash basis, and preserves these records for 6 years.

Comparison

Table 4: Income Tax vs. FCRA Bookkeeping

| Aspect | Income Tax | FCRA |

| Books | Ledger, cash book, journal | Separate FC accounts |

| Preservation | 10 years | 6 years |

| Method | Not specified | Cash basis for FC-4 |

Pros and Cons

Pros:

Cons:

Charitable Organisations – Taxation & Compliance (Legal Research Guide) Th...

How to File Annual Returns Under FCRA (Form FC-4) 3.1 Legal Framework Section 19 of t...

Difference Between Trust, Society, and Section 8 Company Selecting the right NGO structure (Trus...

How to Form a Section 8 Company: Procedure, Benefits & Pitfalls A Section 8 Company (Compa...

PUBLIC INSTITUTIONS EXEMPT FROM TAX [SECTION 10] The Income Tax Act of India, under S...

Income from Business by NGOs: Section 11(4A) Explained Legal Framework (Sections 11(4) and 11(4A...

Latest Rules for Renewal of 12AB & 80G Registrations Under current tax law, registe...

Electoral Trusts and Electoral Bonds: An In-Depth Overview 1. Introduction Political funding...

A Complete Guide to Legal Structure, Registration, and Taxation of NPOs in India Introduction ...

What is a REIT? A Real Estate Investment Trust (REIT) is a company that owns, manages, or ...