Understanding Charitable Trusts in India

In India, the most commonly understood form of constitution for achieving charitable objectives is a trust. A trust, created for charitable and/or religious purposes, can be constituted by a simple declaration made according to the wishes of the author of the trust to accomplish the intended objectives.

What is a Trust?

According to Webster's New Dictionary, trust means "confidence, publication, and responsibility." However, there is no specific definition of "trust" under the Income Tax Act. In common parlance, a trust is understood as an entity established based on confidence and responsibility, often requiring trust registration to gain legal recognition and compliance with regulatory frameworks.

Section 3 of the Indian Trusts Act, 1882, defines a trust as:

"A trust is an obligation annexed to the ownership of the property and arising out of confidence reposed in and accepted by the owner, or declared and accepted by him, for the benefit of another, or of another and the owner."

Eligibility criteria

What is a Charitable Trust?

A charitable trust is a legal entity established for charitable purposes, such as the relief of poverty, education, or the promotion of religion. In India, charitable trusts are regulated by the Indian Trusts Act of 1882 and must register with the Registrar of Trusts in the state where the trust is located. The registration process and eligibility requirements can vary depending on the state.

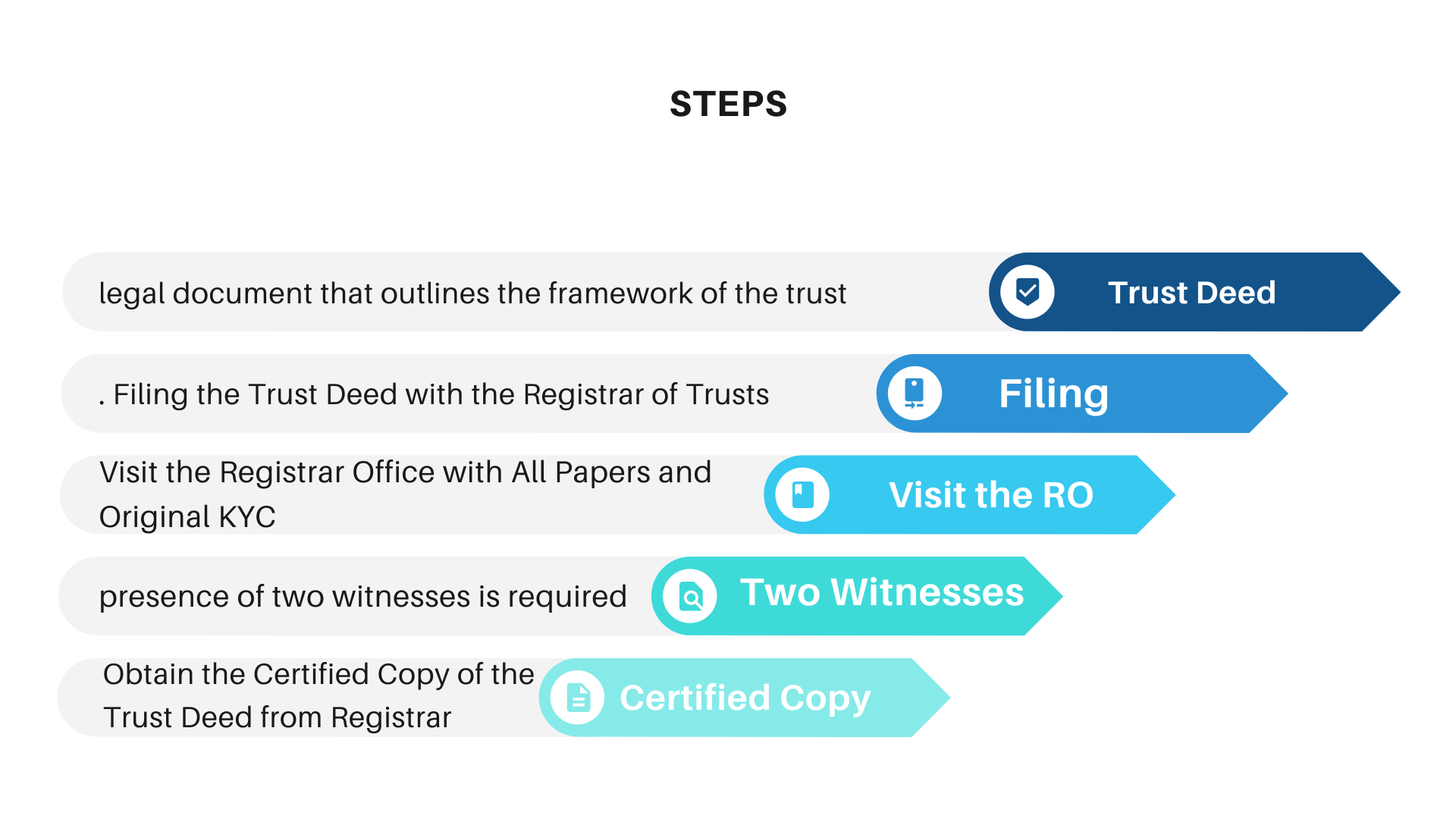

Steps to Register a Charitable Trust in India

Registering a charitable trust in India involves a detailed process to ensure the trust is legally recognized and can operate effectively. Here is an expanded explanation of each step

1. Drafting of Trust Deed

The trust deed is a legal document that outlines the framework and governance of the trust. It is crucial as it serves as the foundation for the trust’s operations.

Choosing a unique name is essential to avoid any confusion with existing trusts. For example, "Shiksha Education Trust" clearly indicates its purpose related to education.

This section should clearly state the intention behind forming the trust, such as promoting education, healthcare, or any other charitable purpose. For instance, a trust formed to provide free medical services to the underprivileged will state this intention explicitly.

The trust property or corpus fund is the initial amount of money or assets set aside for the trust’s activities. For example, if a philanthropist donates ₹5,00,000 as the initial corpus, this amount will be mentioned in the trust deed.

Clearly defining the objectives ensures that the trust’s activities are focused and measurable. For example, "to provide scholarships to underprivileged students" is a specific objective.

The settlor is the person who creates the trust. For example, if Mr. Ramesh Kumar, an industrialist, decides to form a trust, he will be the settlor.

Trustees are individuals or entities responsible for managing the trust. For instance, the board might include professionals from diverse fields to bring in expertise.

This clause outlines the procedure for dissolving the trust if necessary. For example, it may state that upon dissolution, the remaining assets will be transferred to another trust with similar objectives.

2. Filing the Trust Deed with the Registrar of Trusts

The next step is to file the trust deed with the Registrar of Trusts in the relevant state.

Both copies must be signed by the settlor and the trustees.

Documentation such as a rent agreement, NOC from the landlord, utility bills, and house tax receipts are required to prove the location of the trust’s registered office.

KYC (Know Your Customer) documents include identity and address proofs of all individuals involved. This ensures transparency and accountability.

3. Appointment from Registrar for Registration of the Trust Online

An appointment is scheduled with the Registrar of Trusts for the physical submission of documents. This step often involves booking a slot online.

4. Visit the Registrar Office with All Papers and Original KYC

On the appointed day, the settlor and trustees must visit the Registrar's office with all original documents and KYC proofs.

5. Two Witnesses

The presence of two witnesses is required during the registration process. These witnesses must also carry their identification documents.

6. Registration of the Trust Deed

The Registrar verifies the documents, and upon satisfaction, the trust deed is officially registered. This step is crucial as it gives the trust legal recognition.

7. Obtain the Certified Copy of the Trust Deed from Registrar

After registration, a certified copy of the trust deed is issued by the Registrar. This document is essential for all future legal and administrative purposes.

Documents required

• trust Deed with the respective stamp value.

• Two Photographs of the parties in the trust.

• PAN Card of the individuals having a trust.

• Address Proof of the Individuals.

• Identity Proof of the Individuals.

• Authentication from the Partners.

• No Objection Certificate for using the Premises

• Any form of Utility Bill.

• Address Proof of the Registered Office of the Trust

12A and 80 G Certificate from the respective income tax authorities to claim any form of deductions

Case Studies

Case Study 1: XYZ Education Trust

Mr. Anil Sharma, a retired teacher, decided to form a trust to support the education of underprivileged children in his hometown. He followed the steps above meticulously:

• He named his trust "XYZ Education Trust."

• He stated the intention as providing scholarships and educational resources.

• He set an initial corpus of ₹3,00,000.

• He clearly outlined the objectives, such as building a library and funding school fees.

• He appointed himself as the settlor and included a diverse group of trustees, including a lawyer and a local school principal.

• He included a dissolution clause stating that any remaining funds would go to a similar charitable organization.

• He gathered all necessary documents and scheduled an appointment with the Registrar.

• After completing the registration process, he received the certified copy, and "XYZ Education Trust" began its operations, eventually helping over 500 students in its first year.

Stamp Duty and Trust Deed Registration in Delhi

When creating a trust deed in Delhi, understanding the associated costs and timeframes is essential. Here is a detailed breakdown of the process:

Stamp Duty Calculation

Stamp duty in Delhi is calculated based on the initial corpus fund of the trust. The current rate is 3%. For example, if the initial corpus fund is Rs. 1100, the stamp duty would be calculated as follows: Stamp Duty=1100×3%=Rs.33

However, it is advisable to use a stamp paper of Rs. 100 for such transactions.

Time Required for Registration

The registration process for a trust deed typically takes approximately 5 to 7 days.

Total Cost Incurred

The total cost involved in the registration process includes not only the stamp duty but also professional fees for drafting the trust deed. The overall expenses generally range between Rs. 15,000 to Rs. 20,000.

Summary

• Stamp Duty Rate: 3% of the initial corpus fund

• Example Calculation: Rs. 1100 corpus fund → Rs. 33 stamp duty (preferably Rs. 100 stamp paper)

• Time for Registration: 5 to 7 days

• Total Cost: Rs. 15,000 to Rs. 20,000 (including professional fees)

For a smooth and efficient registration process, it is recommended to plan for these costs and timeframes in advance.

given here is a sample for a trust deed , click on it for your reference

How to Form a Section 8 Company: Procedure, Benefits & Pitfalls A Section 8 Company (Compa...

Income from Business by NGOs: Section 11(4A) Explained Legal Framework (Sections 11(4) and 11(4A...

BOI (Body of Individuals) and AOP (Association of Persons) are two different terms used in Indian ...

How to Register Under DARPAN Portal and Its Relevance for NGO Grants Introduction The...

Foreign Travel for NGO Work: Does It Require FCRA Approval? The FCRA governs the acce...

Taxation of AOP (Association of Persons) Based on Member Share Determinability 1. Where Share of...

Tax Implications of Foreign Donations Without FCRA Registration Overview of FCRA Requir...

Maintaining Books of Accounts for NGOs Legal Framework Maintaining accurate books of ...

Difference Between Trust, Society, and Section 8 Company Selecting the right NGO structure (Trus...

Introduction: Section 8 Companies, a distinctive provision under the Companies Act, 2013, embody ...